Maximizing Profits with Kelly Criterion Strategy

Hey there, future betting whiz! If you’ve ever dipped your toes into the world of sports betting, you might have heard of something called the Kelly Criterion. It’s a nifty little formula that can help you maximize your profits while keeping your risk in check. Whether you’re a betting newbie or a seasoned pro, understanding and applying the Kelly Criterion can seriously up your game. So, let’s dive into the world of smart betting and discover how you can use this strategy to your advantage! The actual Interesting Info about بهترین سایت شرط بندی.

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets. Developed by John L. Kelly Jr. back in the 1950s, this strategy helps bettors decide what percentage of their bankroll to wager on a given bet to maximize their long-term growth. Unlike just winging it or betting randomly, the Kelly Criterion provides a systematic approach to making informed decisions. Pretty cool, right?

Origins and History

The Kelly Criterion was originally developed for telecommunications and not for betting. John L. Kelly Jr. was a scientist at Bell Labs, and he intended the formula to optimize signal transmission. Over time, savvy gamblers and investors recognized the broader potential of his work. They began adapting it to financial markets and betting, where it gained popularity for maximizing profit while minimizing risk.

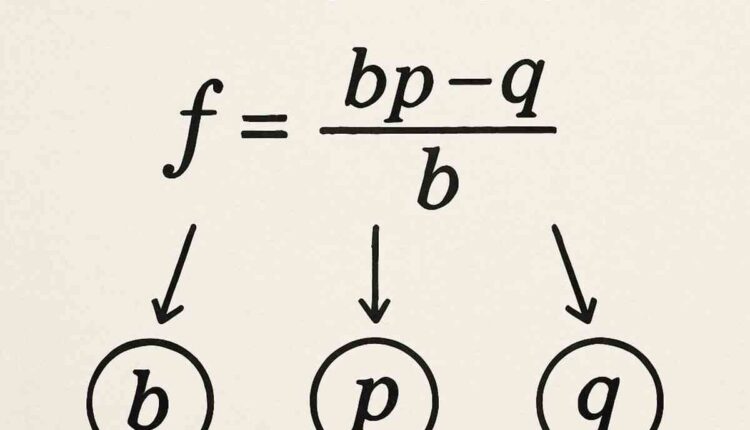

Understanding the Mathematics

At its core, the Kelly Criterion balances the probability of winning with the odds offered by the bet. This balance ensures that you’re not just throwing money at a hunch but making calculated decisions based on mathematical principles. The formula’s genius lies in its simplicity, yet it requires an accurate estimation of probabilities, which is often the challenging part.

The Kelly Criterion in Modern Betting

Today, the Kelly Criterion is a cornerstone strategy for many professional bettors. It’s admired for its ability to guide bettors in optimizing their stake sizes, thereby protecting their bankrolls from the volatility inherent in betting. While initially designed for individual bets, the principles of the Kelly Criterion have been adapted for portfolio management, further showcasing its versatility.

Why Use the Kelly Criterion in Sports Betting?

You might be wondering why you should bother with this fancy formula when you can just go with your gut. Well, the Kelly Criterion has some seriously compelling benefits:

Maximize Long-Term Growth

By betting the optimal amount, you increase your chances of growing your bankroll over time rather than risking it all on a hunch. The Kelly Criterion focuses on compounding growth. Unlike other methods that might suggest risking large portions of your bankroll, this strategy ensures that even small, consistent gains can accumulate significantly over time.

Control Your Risk

The formula automatically adjusts your bet size based on the perceived edge you have, ensuring you never bet too much on uncertain outcomes. This dynamic adjustment is critical in maintaining a sustainable betting strategy. It inherently prevents you from making disproportionately large bets that could jeopardize your bankroll during inevitable losing streaks.

Avoid Over-Betting

It’s easy to get caught up in the excitement and bet more than you should. The Kelly Criterion helps you stay disciplined. By determining the optimal bet size, the formula ensures you’re betting within your means, reducing the likelihood of emotional decision-making which often leads to over-betting and potential bankroll depletion.

Customizable for Personal Preferences

You can tweak the formula to match your risk tolerance. If you’re more conservative, you can bet a smaller fraction of your bankroll. This flexibility allows you to adjust your strategy based on your comfort level. Whether you’re risk-averse or willing to take a more aggressive stance, the Kelly Criterion can be modified to reflect your personal betting philosophy.

Calculating the Kelly Criterion: A Step-by-Step Guide

Alright, now let’s get into the nitty-gritty of calculating the Kelly Criterion for a sports bet. We’ll walk you through an example to make it crystal clear.

Step 1: Gather the Odds and Probabilities

First things first, you’ll need to know the odds and your estimated probability of winning. Let’s say you’re betting on a football match with the following details:

- Odds of Your Team Winning: 2.5

- Estimated Probability of Winning: 0.6 (or 60%)

Understanding the odds is crucial as they reflect the bookmaker’s prediction of the event outcome. Accurate probability estimation can be the difference between a profitable bet and a loss. Research, statistics, and expert opinions can aid in forming a realistic probability estimate.

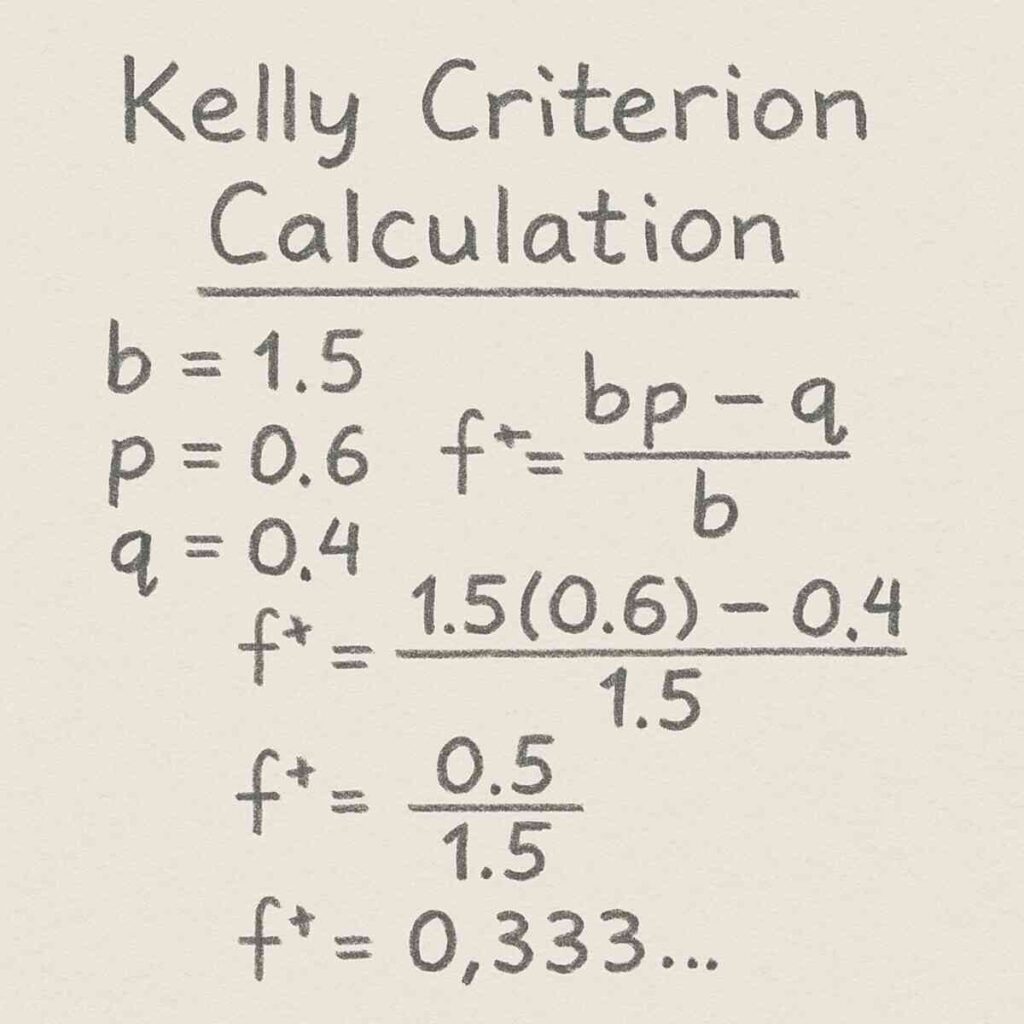

Step 2: Calculate the Variables

Using the formula, calculate the necessary variables:

- B (Odds – 1): 2.5 – 1 = 1.5

- P (Probability of Winning): 0.6

- Q (Probability of Losing): 1 – 0.6 = 0.4

This step involves basic arithmetic but is crucial for correct application of the formula. It’s important to double-check these calculations, as any mistake can lead to incorrect bet sizing. Even small errors in estimating probabilities can significantly affect outcomes.

Step 3: Plug Into the Formula

Now, plug these values into the Kelly Criterion formula:

K% = (1.5 * 0.6 – 0.4) / 1.5

K% = (0.9 – 0.4) / 1.5

K% = 0.5 / 1.5

K% = 0.3333…

So, according to the Kelly Criterion, you should bet approximately 33.33% of your bankroll on this particular wager. It’s a straightforward calculation once you have the numbers. However, remember that this percentage is based on the accuracy of your probability estimates. Adjustments might be necessary if your estimates change or if you gain new information.

Tips for Using the Kelly Criterion Effectively

While the Kelly Criterion is a powerful tool, it’s not a guaranteed path to riches. Here are some tips to make the most of this strategy:

Ensure Accurate Probabilities

The formula relies heavily on your probability estimates. Make sure your analysis is as accurate as possible. Utilize data analytics, historical performance, and expert insights to refine your probability calculations. The more precise your estimates, the more effective your use of the Kelly Criterion will be in managing risk and optimizing returns.

Practice Robust Bankroll Management

Never bet more than you can afford to lose. The Kelly Criterion helps manage risk, but there’s always a chance of losing. A disciplined approach to bankroll management ensures that you can withstand losing streaks without significant impact. Set aside a dedicated bankroll for betting and adhere strictly to the calculated bet sizes.

Maintain Consistent Application

Stick to the strategy and avoid deviating based on emotions or hunches. Consistency is key when applying the Kelly Criterion. Emotionally driven betting decisions often lead to inconsistency and potential losses. By maintaining a disciplined approach, you increase the likelihood of long-term profitability.

Adjust for Personal Risk Tolerance

If the calculated fraction feels too high, consider betting a smaller portion to suit your comfort level. The Kelly Criterion is not a one-size-fits-all strategy. Tailoring it to align with your personal risk appetite can make the betting experience more enjoyable and sustainable. Consider using a fractional Kelly approach if full Kelly bets feel too aggressive.

The Downsides of Kelly Criterion

No strategy is perfect, and the Kelly Criterion has its limitations:

Complexity for Beginners

For beginners, the math might seem daunting. But once you get the hang of it, it becomes second nature. The initial learning curve can be steep, but with practice, the calculations become more intuitive. Starting with smaller bets while learning can mitigate potential early mistakes.

Dependence on Accurate Estimates

If your probability estimates are off, the strategy might not work as intended. The effectiveness of the Kelly Criterion is contingent upon the accuracy of your assessments. Regularly review and refine your estimation processes to ensure they remain as precise as possible.

Managing Variance

Even with optimal bet sizes, there’s always a chance of a losing streak. Variance is an inherent part of betting. The Kelly Criterion can’t eliminate this risk, but it can help manage it by ensuring bet sizes are proportional to your edge. Understanding and accepting this variance is crucial for long-term success.

Conclusion: Bet Smart with the Kelly Criterion

So, there you have it—the Kelly Criterion demystified! By using this strategy, you can make more informed betting decisions, manage your risk, and maximize your long-term profits. Remember, sports betting should always be fun and approached responsibly. With the Kelly Criterion in your toolkit, you’re well on your way to becoming a savvy bettor. Happy betting!

The journey to mastering the Kelly Criterion involves both understanding its mathematical foundation and applying it consistently. As you grow more confident in its use, you’ll likely find that it becomes an integral part of your betting strategy, providing clarity and structure in the often chaotic world of sports betting.